ZoomInfo vs. Lusha - Which Sales Intelligence Platform to buy?

Table of Contents:

There are two things that SaaS companies desire the most—data and dollars. And only a few companies can boast of having them both in abundance. By virtue of the niche that they operate in, most companies in the data as a service (DaaS) space have access to plenty of data and bountiful dollars.

If you landed on this article after reading its headline, you are probably thinking of investing in a good sales intelligence platform like ZoomInfo, Lusha, Slintel, BookYourData or LinkedIn’s Sales Navigator.

It’s par for the course for every growing SaaS company to invest in such a platform not just to enrich sales but also to generate marketing leads or find great talent to hire.

For sales teams, a sales intelligence software is a godsend because lead gen is a top-of-mind concern for every sales team. Outsourcing their lead gen activity to a specialized software can help them save time and invest their resources in more meaningful areas like discovery calls, refining their sales pitch, or devising an effective account-based sales strategy.

In this post, we will take a closer look at ZoomInfo and Lusha—two of the many companies in the DaaS capital that have made great headways in recent years.

Through this blog post, we hope to help you arrive at the decision of which one to invest in—ZoomInfo or Lusha, based on your business use cases.

The genesis of ZoomInfo and Lusha

ZoomInfo’s origin

ZoomInfo (founded in 2000) was acquired by DiscoverOrg (founded in 2007) and rebranded itself as ZoomInfo in 2019. Henry Schuck and Kirk Brown were fresh college graduates when they decided to launch DiscoverOrg from their dorm rooms in Ohio. They had a tough fight ahead of them since they were a completely bootstrapped two-person company competing with RainKing—a business contact information platform that also started in 2007 but had a better business model.

For the next 10 years, DiscoverOrg took it head-to-head with RainKing and acquired the competition in 2017 for over $100 million. Since then, DiscoverOrg has been on an acquisition spree. In the last 6 years, the company has made 12 strategic acquisitions, buying out companies like:

- iProfile (2015)

- Tellwise (2017)

- RainKing (2017)

- NeverBounce (2018)

- Datanyze (2018)

- ZoomInfo (2019)

- Komiko (2019)

- Clickagy (2020)

- EverString (2020)

- Insent (2021)

- Chorus.ai (2021)

- RingLead (2021)

With the acquisition of Chorus.io in 2021 at a reported $575 million value, it’s clear that ZoomInfo wants to dominate the “selling to sellers” market segment.

Since Feb 2019, Henry has been the CEO of ZoomInfo. ZoomInfo became a Nasdaq-listed public company (ticker symbol: ZI) in June 2020—one of the first companies to go public in the thick of the COVID-19 outbreak amidst a virtual event. Today, the company employs more than 2,800 people across its seven global offices and is valued at a market cap of $21.10 billion.

How Lusha began

Lusha was founded in 2016 by Israeli founders Assaf Eisenstein and Yoni Tserruya in Tel Aviv. At the time of writing this article, Yoni is heading Lusha as its CEO while Assaf is the company President.

The duo started Lusha as a side project—originally to help HR teams source better talent for hiring. They later expanded Lusha’s capabilities to cater to sales teams who had similar requirements—of finding the right kind of customers—and turned it into their main focus. Today, Lusha primarily helps B2B sales teams improve their prospecting with high-quality data and offers overlapping capabilities for marketing and recruiting teams.

Lusha scaled to gain 12,000 customers and 80 employees within just four years of their inception—completely bootstrapped. The company hasn’t made any acquisitions yet, but it got funded in November 2021 when it raised Series B capital of $205 million—skyrocketing its valuation to $1.5 billion and earning the coveted Unicorn status.

ZoomInfo and Lusha—two entirely different approaches to market

ZoomInfo takes a sales-led approach

ZoomInfo has grown to become a profitable company mostly by acquiring other profitable companies. They have mastered the art of increasing business margins by putting sales at the center of their GTM motion. In fact, the business positions itself as a GTM platform for B2B sellers.

Here’s what Casey Hill, Head of Growth at Bonjoro, had to say about his experience with ZoomInfo’s sales team:

In one of his recent podcast appearances, ZoomInfo’s CEO made a bold admission that credits their GTM as their growth lever to success:

There were points in the history of ZoomInfo where we had the worst product but we were still winning more. And it’s because we had a better GTM motion and we laid out our vision better. Go-to-market motion can win the day.

- Henry Schuck, CEO, ZoomInfo

ZoomInfo has complex implementation requirements—which might be a reason why the company has “ZoomInfo University” to help its users get used to the product. ZoomInfo offers sales touches for customers who want to know more about its pricing plans—making their SaaS solution a product-led but sales-assisted GTM.

It’s also worth mentioning that Zoominfo got somewhat lucky in its GTM strategy (especially in the immediate aftermath of the COVID outbreak) because a lot of users assumed ZoomInfo to be a subsidiary of Zoom—one of the fastest-growing companies during the pandemic with 383% increase in its value since January 2020. It rode on the coattails of a bigger, better company along with its own set of GTM success.

Lusha takes a PLG approach

Lusha’s GTM strategy is on the opposite end of the spectrum. The company prides itself in offering a completely product-led, self-service model of user experience.

Lusha grew rapidly in the first four years since its founding with zero marketing budget because we took a product-led growth approach. Back then, we didn’t know that a term like PLG existed—but that’s what we did unknowingly.

Lusha made it easy for our users to register, start using the platform, see the quality of data first-hand, and buy the product if they needed to scale. This eventually created a word-of-mouth effect for us and brought more people to Lusha.

- Yoni Tserruya, CEO, Lusha

The key difference between ZoomInfo and Lusha

ZoomInfo’s forte lies in generating high-quality intent data

At its core, ZoomInfo gives you access to comprehensive business contact information about your target audience combined with accurate, real-time analytics on buyer intent. This information can help you improve the quantity and quality of sales leads.

At a more advanced level, ZoomInfo offers advanced sales intelligence capabilities like CRM integration, lead capturing, market intelligence, and sourcing accurate buyer intent data. With business contact data of 130 million users, ZoomInfo boasts of an extensive database in the B2B space.

Compared to other sales intelligence tools, ZoomInfo offers buyer intent analytics that improves the accuracy and quality of lead data. This is a massive advantage for teams looking to source high-quality lead information because cheaper point solutions like Apollo.io don’t provide intent data in the same depth as ZoomInfo—requiring your sales team to manually sort through a massive amount of information to qualify leads.

Lusha is user-friendly and affordable

Lusha’s biggest differentiation from ZoomInfo is that its market positioning, features, and pricing are optimized for small startups. Lusha offers a clean user interface that is easy to navigate and start using. First-time users don’t need to spend a lot of time getting used to Lusha’s interface because the product has little to no learning curve.

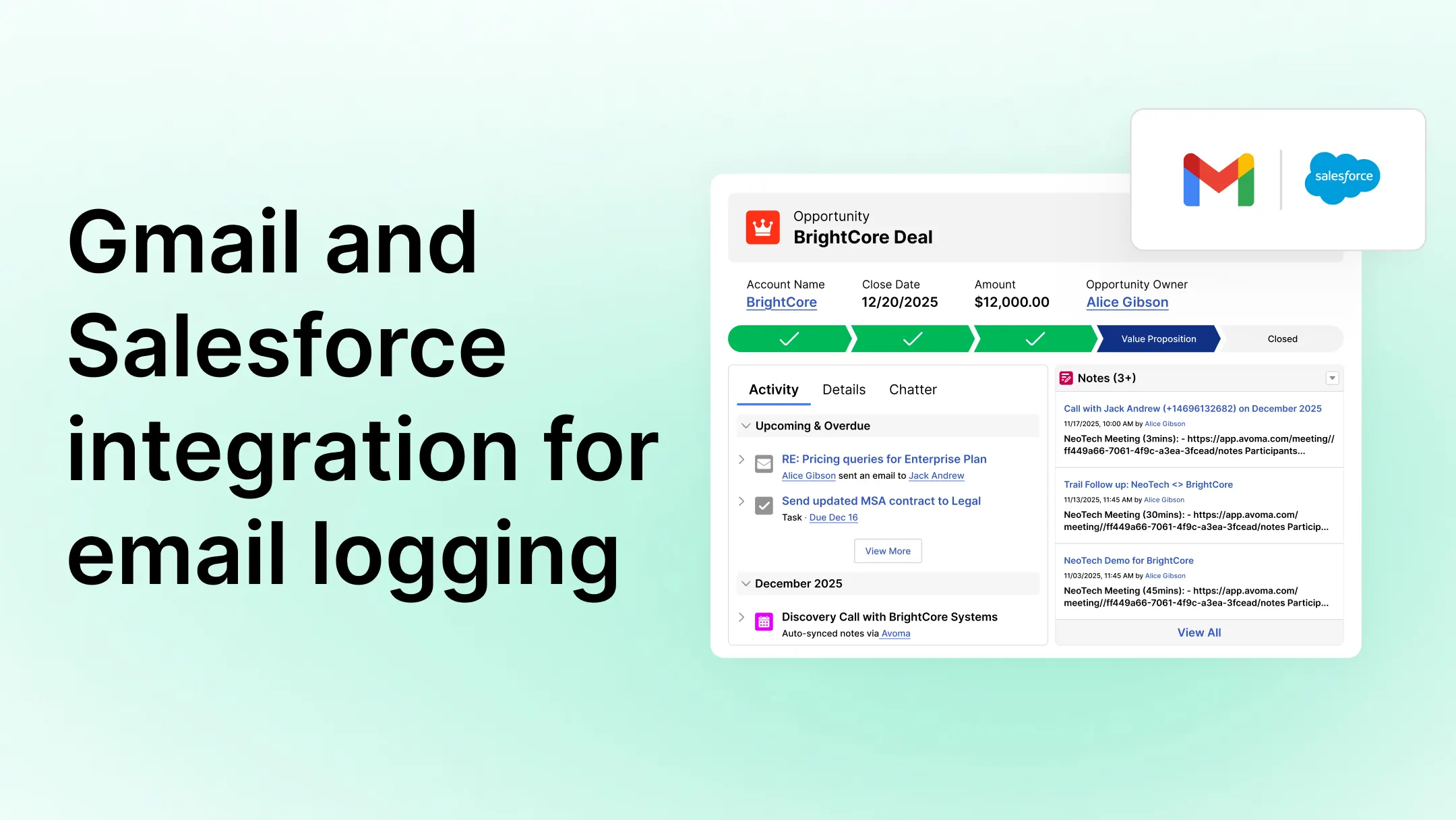

Keeping up with the standard practice in the sales intelligence domain, Lusha offers a Chrome browser extension that users can install to bulk enrich prospect data from LinkedIn’s Sales Navigator, Salesforce, or other online portals without switching your browser tab.

How to choose between ZoomInfo and Lusha?

Both ZoomInfo and Lusha have hundreds of thousands of customers and glowing reviews on software review sites, and have pretty comparable offerings from a product and functionality perspective. Given all this, it’s difficult to choose between the two. But at the same time, they both are targeted at different audiences.

That’s why we’re here to help. But before pulling the trigger to choose between two, let’s first consider the two key factors to evaluate these tools.

Key factors for evaluation

1. Product features or functionality

This is probably the most important aspect of evaluating two similar solutions, to check if they offer comprehensive and comparable functionality.

Few questions to consider:

- How comprehensive is the product functionality and features?

- What integrations do they support?

- Do they support natively or via some third-party API connectors?

- What functionality is flexible, customizable, etc.?

- What are your needs? Do you need all the bells and whistles?

2. Pricing

This is not the most important aspect of making a purchase decision, but everyone wants to buy an affordable solution, that also is the best of breed.

Few questions to consider:

- Do you really need all those functionalities?

- Is it an overkill at your current business stage or not?

- Are you going to pay for something that looks fancy, but you are not going to have time to use it actively?

- Is there a minimum platform fee?

- Is the pricing affordable, flexible and fair?

Comparing ZoomInfo and Lusha

Having seen the overview of how ZoomInfo and Lusha position themselves and the key factors for evaluation, let’s now get into the actual evaluation.

The TL;DR version

Here’s how Zoominfo and Lusha stack against each other.

.png)

1. Features

ZoomInfo

ZoomInfo data sourcing of business contact information is really granular—and possibly the best in the sales intelligence category. Here’s what a ZoomInfo use has to say about his experience of using ZoomInfo:

Zoominfo has a sophisticated industry filtering process. For example, if I want to find a list of tier two banks immediately, Zoominfo will give this to you. If I want to find companies that have more than three trucks in operation, Zoominfo is probably the only place where you will find that kind of information.

- Jack Reamer, B2B lead generation expert, SalesBread

Here’s a list of all features that ZoomInfo offers:

- Lead builder

- Lead analysis and intelligence

- Native integration with 25 other apps (including 14 CRM)

- Data enrichment

- Data segmentation

- People alerts

- Data reporting

- Account-level market insights

ZoomInfo’s wide range of integrations across all functions gives it an upper hand over smaller players like Lusha.

For instance, ZoomInfo natively integrates with 14 different CRMs and marketing automation platforms like Hubspot, SalesForce Pardot, and NeverBounce—making it a handy tool for sales and marketing teams. Similarly, its seamless integration with JobDiva and Greenhouse makes it a tempting choice for HR teams too.

Compare this with Slintel—another heavy-hitter in the sales intelligence space—which only integrates with three top CRMs: Salesforce, HubSpot, and Pipedrive. Even Sales Navigator offers limited CRM integrations with Salesforce and Microsoft Dynamics 365—you have to take the API route to integrate Sales Nav with other tools.

Lusha

Going by our research and also talking to some customers, Lusha doesn’t seem to be a match for ZoomInfo when it comes to providing up-to-date accurate information.

According to Richard Lubicky of RealPeopleSearch, “Some of the information (we found in Lusha) was outdated or fake.”

But that said, data accuracy is continuous work-in-progress for all providers. Lusha does offer some amazing features for SMB SaaS that accelerates the customer’s time-to-value.

One of Lusha’s features allows you to improve email prospecting and increase your chances of getting back a response by sourcing verified email IDs. This is a good offering since it helps you filter through Lusha’s 100 million business contacts and save time in reaching out to the right accounts.

If you break down the database further, Lusha has an ever-growing list of 60 million email addresses, 50 million direct dials, and 15 million company profiles listed on its platform.

Lusha also has an active community of contributors who volunteer their data to Lusha. They incentivize their users to contribute data on the platform in exchange for selected Lusha’s capabilities that they can use for free.

In Yoni’s words, Lusha’s idea behind setting up such a community stems from the vision of wanting to build the world’s biggest community of salespeople who can help each other validate the data quality on the platform.

This is a far-sighted move on Lusha’s part to verify user data from multiple sources and maintain up-to-date information as much as possible. Today’s B2B space is extremely dynamic—people change their jobs approximately every three years, their companies go through mergers and acquisitions, and a lot of information can change over time. Having a community-powered, open-sourced data aggregation and verification process can help the company maintain data sanity in the long term.

Does ZoomInfo have a community?

To be fair, ZoomInfo also has a Community Edition that incentivizes similar participation from its users, but it doesn’t highlight its community features as much as its other capabilities.

Here’s a list of other major features that Lusha offers:

- Lead intelligence

- Lead monitoring

- One-click integration with 3 major CRMs

- Custom API integration

- Data cleaning and enrichment

- Only verified email search

- Ease of managing user role and access

- Reporting and analytics

Compared to ZoomInfo, Lusha disappoints on the integration front. As of now, Lusha only offers out-of-the-box integration with Salesforce, HubSpot, and Outreach CRMs. To integrate other tools with Lusha, you will have to depend on custom APIs—which don’t offer as seamless flow of data across tools as native integration.

When we first bought the platform, we thought Lusha would be able to integrate with some of our other systems. But it doesn't work that way. We had to hire several programmers to help integrate Lusha with our website's shopping cart and another to help with email marketing.

- Madilyn Hill, CEO, TruePersonFinder

2. Pricing

ZoomInfo

Since ZoomInfo serves cross-functional use cases, its pricing is customized to meet different use cases across sales, marketing, and HR.

ZoomInfo does offer a free trial across all their plans, but its website copy doesn’t communicate how long the trial period is for. People who have tried ZoomInfo confirm that the trial period lasts for 14 days.

The platform provides basic, high-level data for free, but you will have to pay a premium subscription fee to access granular data like email addresses, organizational charts, and employee details.

It gets even trickier from there since ZoomInfo doesn’t have flat pricing plans available on its website. Instead, they encourage prospects to get personalized pricing quotes from their sales team. ZoomInfo also doesn’t communicate the fact that it doesn’t have monthly plans but requires customers to sign annual contracts—which roughly start at $15K a year.

It’s a good move to balance the self-service product experience with the right kind of sales assistance for customers who want to talk to sales. But not having an upfront clarity about its subscription costs adds a layer of complexity for users who want to know if ZoomInfo fits their budget.

However, ZoomInfo’s happy customers don’t seem to complain about its complex sales cycle:

We've been paying close to $25,000 a year for our ZoomInfo subscription, and the results so far have been phenomenal. I would definitely recommend others to use it.

- Doug Pierce, CMO, Sigma Computing

This is in stark contrast to smaller ZoomInfo customers who find its price exorbitant. For instance, users like Jack (from SalesBread) find ZoomInfo quite expensive and the export feature “clunky at best”.

The bottom line is—ZoomInfo might be a better fit for bigger companies with deep pockets and not SMBs with a tight sales or marketing budget. 👌

Lusha

Lusha has a wide range of pricing plans and—thankfully—it’s all on their website for users to compare. The few hiccups are in its Starter plan which allows users to get 5 credits every month. It’s not immediately clear if it’s a limited period trial offer, but a deeper investigation shows that it’s a free forever plan with limited offers.

But—Lusha also doesn’t have monthly plans. It forces its customers to buy annual subscription packages upfront.

It also doesn’t have a specific price tag on its Enterprise plan—which is common for many SaaS brands who want to customize their pricing on a case-to-case basis.

Lusha might be a better fit for SMBs with smaller sales and marketing budgets and have the internal resources to validate the intent data. 👌

Final verdict

Comparing ZoomInfo vs Lusha head-to-head, both are great tools in their own right. When it comes to deciding which platform is best for you, it boils down to two things—data quality and budget.

1. If you can afford to spend thousands of dollars every year to source high-quality buyer intent data—go with ZoomInfo.

2. If you are a growing business that can’t afford exorbitant tech tools—and if you have other resources to validate intent data internally—test the waters with one of Lusha’s low commitment subscription plans. You can upgrade to a platform like ZoomInfo later—if needed.

Frequently Asked Questions

What's stopping you from turning every conversation into actionable insights?